Global personal finance software

Contents:

Here are some key steps to take at different https://1investing.in/ stages. But creating a budget happens to be the one step that makes every other financial goal reachable. In this guide, we are going to focus on breaking down the most important areas of personal finance and explore each of them in more detail so you have a comprehensive understanding of the topic. “This article was super helpful! I’ve created my own system and have no problem keeping track of my money.”

Can you do bookkeeping by yourself?

Bookkeeping is something that you either have to learn or outsource when you're running a business. Luckily, it's possible to learn how to manage your own books and there are a few notable benefits to tackling it yourself.

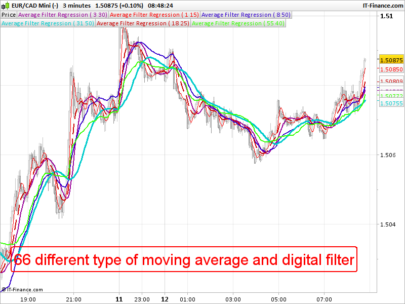

These best free personal finance software will, without a doubt, make your financial life more stable and without complications. This list of free personal finance software is highly researched and reliable. There are a ton of personal finance apps available both for mobile phones and web browsers that offer services to track, tabulate, and analyze your expenses. These apps also offer a range of comprehensiveness, from simply acting as a budget-creation tool to displaying all your assets in one place. What we look for in the best personal finance software packages is primarily the ease of use factor, combined with the range of features and functions.

Methodology to identify the best budget apps

Should you need such advice, consult a licensed attorney, tax or financial advisor. Throughout the site I recommend or link to various products and services, using text or image links. In some cases, these links are affiliate marketing or sponsored content, which means I may receive some form of compensation related to the link.

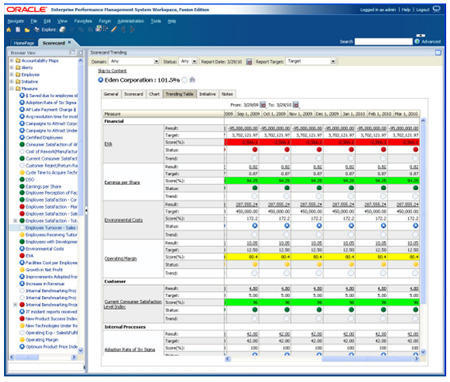

To come up with our list of the best personal finance software, we researched and reviewed several personal finance applications based on criteria important to the consumer. We chose our top personal finance software options after considering factors like price, variety of features, the types of financial goals they help you meet, company reputation, and more. Note that we did not evaluate all options in the market. We chose Quicken as the best overall personal finance software because of its all-around strengths. It helps with creating budgets and tracks debt and expenses while allowing you to export data to Microsoft Excel.

Bill Pay Services for Seniors

In some ways, Greenbooks is easier to use – entering or importing data is a snap, Direct Connect to your bank works well , and there are useful export options. Direct Connect is an extra service that does require a subscription of $2.99/month. You’ll also find many helpful articles and videos that help you use the app. If you need custom care beyond our Elder Care Bookkeeping Support package, let us know. We can customize a package that suits your needs including managing medical and insurance issues, dealing with incoming mail, or arranging for home repairs. This will allow you to spend more quality time with your loved one and they can maintain their independence for as long as possible.

The pandemic that began in March 2020 showed all of these issues in sharp relief and showed the importance of planning for emergencies. Beyond helping you get approved for a credit card, mortgage, car loan, and so on, it helps minimize the interest rate you pay. It’s important to know not only what your credit score is at any given time, but also how it gets calculated and what you can do to improve it. Charts and graphs on the dashboard tell you, for example, what your income is versus your spending, and how you’re doing with your budget.

Empower Personal Wealth, for tracking wealth and spending

Or consider a slightly longer commute, which can also be a big money saver. Big-ticket purchases typically involve taking out a loan. A hidden risk to consider when you are deciding on your mix of stocks and bonds is inflation. That’s the annoying fact that, over time, stuff costs more. Even at a benign 2% inflation rate, what costs $1,000 today will cost more than $1,600 in 25 years. Stocks over long stretches have produced the best inflation-beating gains.

Starling Bank Business Account Review 2023 – Forbes Advisor UK – Forbes

Starling Bank Business Account Review 2023 – Forbes Advisor UK.

Posted: Thu, 06 Apr 2023 21:43:00 GMT [source]

Blue Swan Bookkeeping will ease the demands of the family struggling to balance family and career plus manage their loved one’s daily financial responsibilities. DividendsDividends refer to the portion of business earnings paid to the shareholders as gratitude for investing in the company’s equity. One of our content team members will be in touch with you soon. Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

The ones that connect to your financial accounts, like Mint, use encryption and other safety measures on their side to keep your login information protected. However, you must also do your part to make the experience safe. Our list of the best personal finance software includes free and paid options to suit a variety of financial goals. The chart for monthly breakdown of costs is really helpful, providing both a summary and breakdowns by category. I love the iOS version of the app, which is so simple that now I enter expenses as I make them – not later in the week or month, as was my previous practice.

Should I hire a personal bookkeeper?

They can teach you ways to cut costs, provide insight into your spending, and more. Ultimately, hiring a bookkeeper will help you save money. Hiring a bookkeeper, especially one who can work off-site, helps you avoid financial penalties. Hiring a bookkeeper gives you more time to focus on your business.

For instance, one could read “concerts” while another says “new wardrobe.” Every time you get a paycheck, slide $5 into each envelope and watch your “fun money” grow. When you track your finances, do you find that you’re spending too much in one place? Having a budget for your favorite stores could help you spend less.

Thank you for reading this CFI guide to personal finance. We hope it has helped you understand what managing personal finance is all about, why it’s important, and how to go about doing it. Best free personal finance software are always secure, please make sure you choose one that offers encryption. Try the envelope-saving method by labeling envelopes with what you’re saving for.

Use the information you learn to make adjustments to your budget and spending habits for the next month. Keep an expense and budget notebook that tracks your spending. The simplest way to track your finances is to record each transaction in a notebook. Choose to use the notebook for spending only, or opt for a more detailed approach by logging how much you want to spend and what you end up spending. Keeping track of where your money goes can help you learn what expenses affect your account balance the most. However, the great thing about personal finance software is it has been created specifically for money management needs.

Retirement planning experts recommend adding some Roth retirement savings as a way to create “tax diversification” that can help keep your IRS tab down once you retire. If you’d like to use this free template to help you with your personal finances and planning, please download the Excel spreadsheet and edit it as appropriate to fit your own needs. Additionally, you should always consult a professional advisor before making any financial or investment decisions.

On the higher end, TurboTax Live connects you with a tax expert to give you personalized advice and answer questions about your tax return. Paid versions of TurboTax include a feature to help you uncover deductions you may not have known were available to you. While you can use TurboTax on the web, you can also download the software to your device for added security. To file your personal taxes, you need to know your income and your tax-deductible expenses. This has been a very well rounded course for all areas of one’s life.

- Our easy-to-use software makes it easy to stay on top of your business finances, and your personal bookkeeper is always just a message away.

- The tools you will learn are useful, realistic, and easy to work into your regular routine.

- Debt Wizard Student loan calculator – Based on your intended profession and pay, find out how much student loan you can afford.

- Turn your future payments into cash you can use right now.

We may need additional information to verify your teacher status before you have full access to NGPF. Compare to other software See how we compare with other financial solutions. Advanced accounting Scale smarter with profitability insights. Borrowing as little as possible is how you free up hundreds of dollars in your budget to put toward other goals. A recent study found that the median price of a four-bedroom home was $100,000 more than a three-bedroom.

Remcos RAT Targets Tax Pros to Scurry Off With Workers’ Filing Info – Dark Reading

Remcos RAT Targets Tax Pros to Scurry Off With Workers’ Filing Info.

Posted: Thu, 13 Apr 2023 20:47:47 GMT [source]

Open source how to calculate sales tax is one way of potentially minimizing the risks of privacy and monetization related risks of data exposure. You can connect and monitor checking, savings and credit card accounts, as well as IRAs, 401s, mortgages and loans. The app provides a spending snapshot by listing recent transactions by category. You can customize those categories and see the percentage of total monthly spending each category represents. Budgeting can be a challenge, but it’s a great practice for keeping your spending in check and making sure your bills are covered.

We also gave unofficial bonus points for nice-to-have features, such as showing credit score and net worth, as well as investment trackers and detailed help guides. We also noted apps that were free or relatively inexpensive. Mint is impressive in many ways, including the fact that it tracks just about everything on your behalf. But that may not be ideal if you’re looking to be more actively hands-on in your budgeting. If you’re searching for an app in which you plan ahead for your money, rather than track it after the fact, other apps on our list may work better for you. Many seniors have multiple sources of income, including social security, pensions, annuities, IRA, 401k, investments, and other retirement accounts.

It contributes to better cash flow and liquidity management for taxpayers, as well as better retirement plans and investment opportunities. Financial managers create reports, develop plans, guide investment decisions and set long-term financial goals for their organization. The U.S. Consumer Financial Protection Bureau offers tools and other resources ranging from credit cards to debt collection if you have specific questions about personal finance topics. Income is the foundation of your personal finances and includes all parts of your cash flow – the money you take in from all sources.

What is personal bookkeeping?

Personal bookkeeping, on the other hand, is staying on top of your personal finances. It's essentially expense management and budgeting. It can help you answer questions like: “Am I spending too much on eating out?”

Leave a Reply