disadvantages of large cap stocks: What Is The Difference Between Large Cap, Mid Cap, And Small Cap Funds?

Contents:

Below are the large cap stocks list and examples of companies that issue them. A high degree of transparency – The vast majority of large-cap companies provide all the required filings with the Securities & Exchange Commission and issue regular earnings reports. This allows investors to not only find but analyze public information about the companies they are interested in. Unless there is a specific dividend stock or investing strategy to implement, beginners typically approach the stock market through guesswork.

These companies have steady cash flow and don’t see the same swings of smaller companies. This means large-company funds have more consistent income and are less likely to lose money. When a company makes a profit, it can distribute the money to shareholders or reinvest it back in the company. Large companies are already well-established and don’t need to keep as much money in the business. Therefore, they pay out a higher share of their profits as dividends.

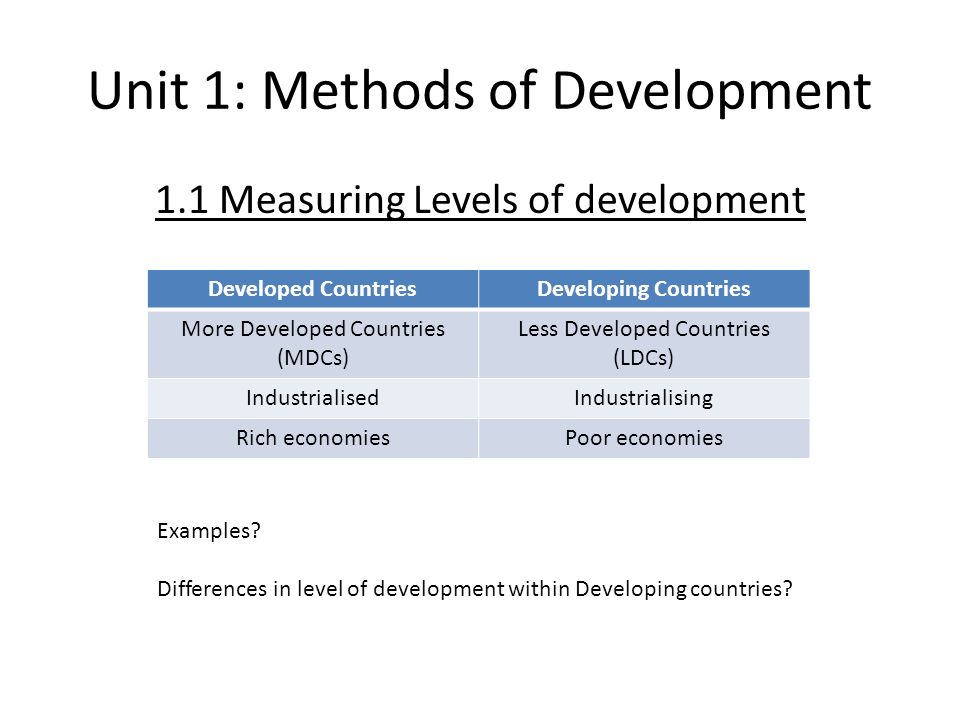

In general, analysts use a $5 billion market cap as the minimum point for a blue-chip stock. With that said, most blue-chip stocks are large-cap stocks because of the way they behave. The generally accepted Wall Street rule is that a large-cap stock is that of a company or corporation with a market capitalization of over $10 billion.

The issue of shares by the company, buy-back/repurchase by the company, significant change in the price of the stock, i.e., sudden rise/fall in price, could impact market cap. Small-cap companies are considered risky for investment compared to mid & large-cap companies. Mid and small-cap stocks generate higher returns against higher risk than large-cap stocks. If you are a low-risk investor, then large-cap stocks are your best bet to grow your wealth without exponentially increasing risk exposure. • If you have an investment horizon of five years or more and prefer low volatility, then large-cap stocks are a good fit.

FIND THE BEST INVESTMENTS FOR YOU

Smaller companies have more room to grow; an investment that a small company makes may double their revenue. Meanwhile, that same investment by a larger company may not make a noticeable difference. Penny stocks are typically stocks that trade at a share price of $5 or below. You can decrease your investment risk by diversifying your portfolio based on your financial goals.

That said, your asset allocation could differ from these types of guidelines based on your risk tolerance and investment goals. Just make sure you understand the potential tradeoffs of your strategy in advance. For example, a company trading at $100 a share with 500 shares outstanding would be worth $50,000 (500 shares x $100). WealthBaskets are combinations of stocks and ETFs indicating ideas, themes, and investment strategies. WealthBaskets are created and monitored by SEBI registered professionals. Incorporated in 2007, ITCONS E-Solutions Limited is a New Delhi-situated company engaged in the business of providing human resource services.

- Despite higher share prices, though, large-cap stocks are generally safer.

- SEBI has identified 100 large-cap businesses based on their market capitalisation, which are listed on the stock exchanges from 1 to 100.

- A well-diversified portfolio should keep you safe if any company goes under.

- Since most companies reinvest profits back into the company to continue to grow, the question for large caps who aren’t looking to grow is what to do with their profits.

- They are well established companies who have been around for a while and have solid product lines they can rely on to generate revenue.

The S&P 500 gained about 15.43% per year over the 10 years ending January 31, 2022. Financial planners suggest you establish yourasset allocationbased on your financial goals and where the economy is in the business cycle. Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California life, accident, and health insurance licensed agent, and CFA. She spends her days working with hundreds of employees from non-profit and higher education organizations on their personal financial plans. The point is, while it isn’t common, it isn’t unheard of to have periods of high volatility that effects all stocks. While they could choose to not invest until they have enough money to buy shares, there are other options for them to choose from.

Reputable management

Before you invest in mutual funds, make sure you check out the most recent lists to know the companies in which the funds invest your money, so you can verify if they are aligned with your risk profile and your investment goals. Lower risk — Large-cap stocks are generally more well-established companies and are therefore less exposed to risk than their smaller counterparts. Large-cap stocks are comparatively safer than mid & small-cap companies. Market Capitalization, also called Market Cap, means the market value of the company’s outstanding shares. Its measurement is by multiplication of stock price with outstanding shares.

What Is A Multi-Cap Fund? Pros And Cons And Who Should Invest? – Outlook India

What Is A Multi-Cap Fund? Pros And Cons And Who Should Invest?.

Posted: Fri, 09 Sep 2022 07:00:00 GMT [source]

The only way to invest in common stocks and avoid this disadvantage is to gain a majority share of a company with your investment. That’s an expensive proposition to consider for most corporations, so it is only available to those with the highest levels of wealth. That’s because this outcome works to create employment opportunities, which then creates more income. As profits get higher, more sales occur, and that means higher levels of consumer demand that drive revenues into the black. If you can identify where a company stands in its business cycle, then your potential to grow wealth through investing in common stock is incredible. Just make sure that you hedge your bets by diversifying your portfolio instead of investing in only one stock.

Diversify To Lower Investment Risk

The investors looking for growth and capital appreciation over time invest in such shares. Obviously such a return is at the cost of low or no dividend income. Such growth stocks are a better investment option for a long term. Investors seeking high returns are not likely to find these types of profits in large company stock funds.

What Are Small-Cap Stocks? How Do I Trade Them? – TheStreet

What Are Small-Cap Stocks? How Do I Trade Them?.

Posted: Thu, 09 Feb 2023 08:00:00 GMT [source]

Online traders make it simple and inexpensive to trade common stocks from major exchanges around the world. You can work with brokers who allow margin trading and short selling for eligible listings. That means you can use borrowed funds to purchase stocks or sell borrowed securities in the expectation of buying them back at a lower price.

The advantages and disadvantages of common stock must be carefully considered, just as they are with any other investment. You have the potential to gain a lot of wealth from this activity, but there is always a risk of loss to manage. That’s why I diversified portfolio that includes these investments is a balanced way to provide for your future. If you decide to purchase stocks on your own, then you must research each company to determine its potential for profitability. It is up to you to learn how to read financial statements and understand the information provided in annual reports. You must also have time to monitor the stock market since even the best company’s prices will fall during market corrections, crashes, or bear environments.

So if a https://1investing.in/ returns 5% and the dividend is 2%, you earn 7% annually. The reason is because you can take the dividend yield and add it the annual return of the stock to get your total return. This dividend is a great way to increase your overall investment return. As a result, you have more predicable income and earnings, which means stable returns over the years. They are well established companies who have been around for a while and have solid product lines they can rely on to generate revenue.

Therefore, these eliminate the risk of exposure to just one stock. However, these are not risk-free investments and also do not guarantee returns. They are small companies that hope to grow into big ones, and there’s potential to profit from that growth, but there’s also the risk that the company will never grow or may even go out of business. Penny stocks are very unlikely to offer dividends, which means you will make money through capital appreciation.

Professional traders and institutional disadvantages of large cap stocks have more time to monitor the stock market and research companies. That means their work has a competitive edge against your investing efforts if you don’t have the same amount of time available. These folks have access to sophisticated trading tools and financial models that reduce their risk factors when making and investing decision. The swath of companies in the middle of the list—or those with market capitalizations that generally fall between $2 billion and $10 billion—are of particular interest to many investors and will be the focus of this article. In the paragraphs below, we’ll look at the pros and cons of this group and why it is a market segment that is worthy of your time and research.

Although you may get awarded with voting rights when purchasing common stocks, it is often difficult or impossible to exercise any control over this investment. If you were to put that money into a company that you control, then your decisions on strategies and best practices can lead to a profitable experience. When you add common stock to your portfolio, then you are subjected to the will of every other stockholder. The average rate of inflation in the United States hovers around 3%. Common stocks have averaged an annualized return of 10% historically. That means the value of your portfolio can grow at a net of 7% each year.

- Read this post to know more about the travel insurance option that you now get while purchasing train tickets on IRCTC.

- Small-cap and mid-cap stocks can issue preferred stocks or dividend-paying stocks.

- This type of stocks belong to companies that distribute consistent and frequent dividends to its shareholders.

- By comparison, small-cap companies are at an earlier stage in the business cycle, with a narrow and targeted business that is still growing.

- Plus, these stocks usually have higher demand, and higher demand leads to higher prices.

As great as these stocks are, there are drawbacks to large cap stocks. This is a way of saying if you have money invested in these companies, you can easily find a buyer for your shares and get cash in exchange. This is in direct contrast to small cap stocks where you might find one or no analyst covering the stock. This is just a short list of large cap investments that make up many investors portfolios.

Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy. A well-diversified portfolio should keep you safe if any company goes under. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. The good news here is this return will still grow your wealth over time and keep you ahead of inflation.

Leave a Reply